The Benner Cycle and 2026: Is History Preparing a Major Breakthrough for the Cryptocurrency and Real Estate Markets?

Date: December 31, 2025 | Author: Global Analyst and Investor

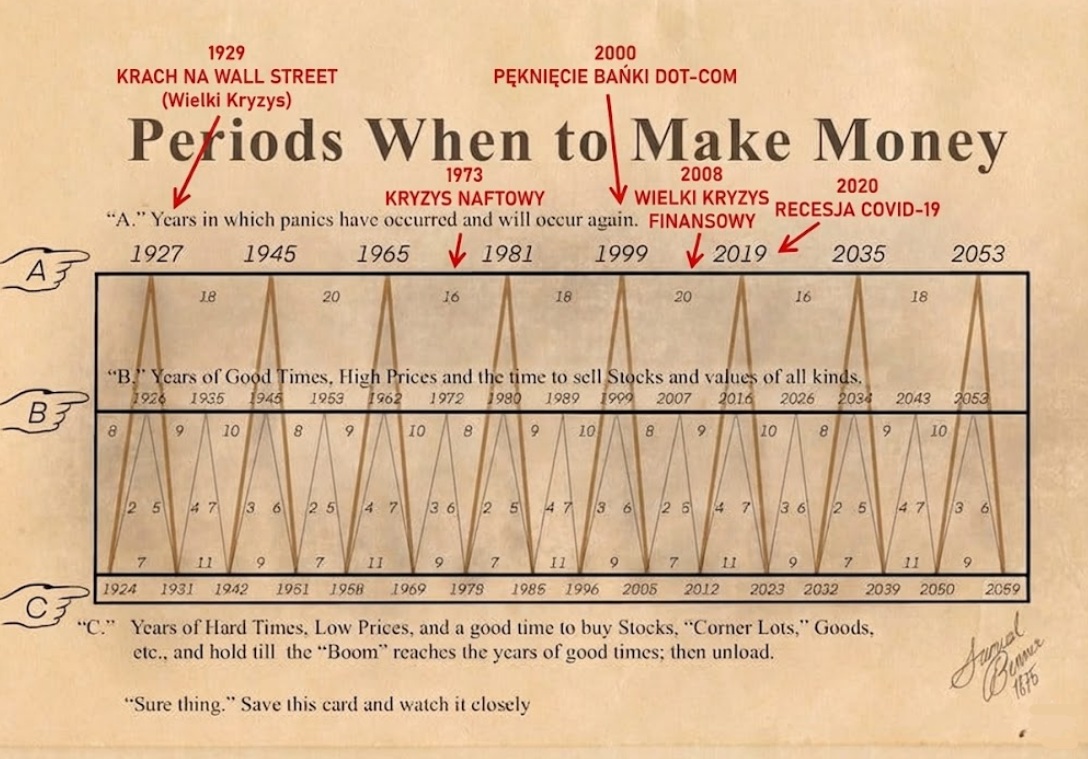

Updated Benner Cycle chart. Source: Own analysis based on historical data.

Introduction: In Pursuit of History's Rhythm – Why Do Old Maps Still Work?

In a world dominated by high-frequency algorithms, artificial intelligence, and instant reactions to central bank communications, paradoxically, more and more experienced investors are looking to the past. Not to go back, but to find repetitive, archetypal rhythms that have steered the tides of fortune in financial markets for centuries. At the center of this renewed interest lies a model over 150 years old – the Benner Cycle. This hand-drawn chart, created by an Ohio farmer who lost his fortune in a crisis, has pointed to peaks and collapses with disturbing accuracy over the last two centuries. Today, as we stand on the threshold of 2026, this cycle is marking another, resounding beat that could coincide with the culmination of euphoria around artificial intelligence, cryptocurrencies, and the global real estate market. As an analyst and practicing investor, I will attempt to translate this historical map into concrete, multi-dimensional scenarios for the coming year, breaking them down into their components and confronting them with the contemporary, ultra-complex macroeconomic reality.

This analysis aims not so much to predict the future, but to build a framework for strategic thinking. In the article, we will delve into the genesis of the Benner Cycle, trace its incredible accuracy, and then examine in detail why 2026 is marked as a potential turning point. We will analyze separately the prospects for two key, yet very different, asset classes: cryptocurrencies (the symbol of the new era) and real estate (the traditional pillar of wealth). Finally, we will formulate conclusions and possible strategies for action, aimed not at maximizing short-term profit, but primarily at protecting capital and being ready for the opportunities that arise only in moments of great transition.

Part 1: From the Cornfield to Wall Street – The Genesis and Mechanics of the Benner Cycle

Samuel T. Benner: Market Philosopher Among Farmers

The history of the Benner Cycle is a story of downfall, perseverance, and unconventional thinking. Samuel T. Benner, a farmer from Ohio, was financially ruined during the Panic of 1873, one of the deepest economic crises of the 19th century. Instead of giving up or seeking blame solely externally, he decided to explore the very essence of economic cataclysms. Armed only with a pen, paper, and historical data dating back to the early 19th century, he began a tedious, multi-year analysis of commodity price fluctuations (especially hogs and corn), business behavior, and stock market quotes. His key, revolutionary discovery for that time was the assertion that the economy is not a set of random events, but a "living organism" moving in predictable, albeit complex, rhythms. Driven not by dry numbers, but by immutable human emotions: euphoria, greed, complacency, fear, and panic.

In 1875, he published his findings in the book "Prophecies of Future Ups and Downs in Prices." His chart, despite its simplicity, was the result of painstaking work. Benner had no access to computers or advanced mathematics. His tools were observation and the search for repetition. He noticed that commodity and stock prices do not move linearly, but cyclically, and these cycles can be linked together. His model did not explain the "why" (fundamental causes), but focused on the "when" (timing), which in investing is often crucial.

Anatomy of the Cycle: Lines A, B, and C – The Rhythm of Panic, Good Times, and Hard Times

Benner distinguished three main types of years that repeat in specific sequences, creating a weave of two main cycles: an 8-, 9-, 10-year cycle for "panic" and a 16-, 18-, 20-year cycle for "booms" and "recessions."

- Panic Years (Line A): Periods of deep crises, sharp declines in asset prices, and economic recessions. Benner observed that panics repeat every 8–9, 16–18, or 20 years, creating a distinct rhythm. Examples from history confirm this pattern: 1837, 1857, 1873, 1893, 1907, 1929, 1987, 2008.

- "Good Time" / Boom Years (Line B): These are periods of prosperity, strong bull markets, rising asset prices, and general economic optimism. According to Benner, these are years ideal for selling and realizing profits, as they precede a downward phase.

- "Hard Time" / Recession Years (Line C): Periods of slowdown, bear markets, and falling prices, which are however – in terms of the cycle – the perfect moment for accumulation and buying high-quality assets at drastically reduced valuations. This is the phase of patient gathering.

Based on these observations, he created a simple, linear chart that – contrary to all contemporary expectations – accurately pointed to the collapses of 1884, 1903, and, most electrifying for modern audiences, the peak before the Great Depression in 1929, the peak of the dot-com bubble in 1999, and the peak before the 2007 financial crisis. This historical accuracy forces reflection.

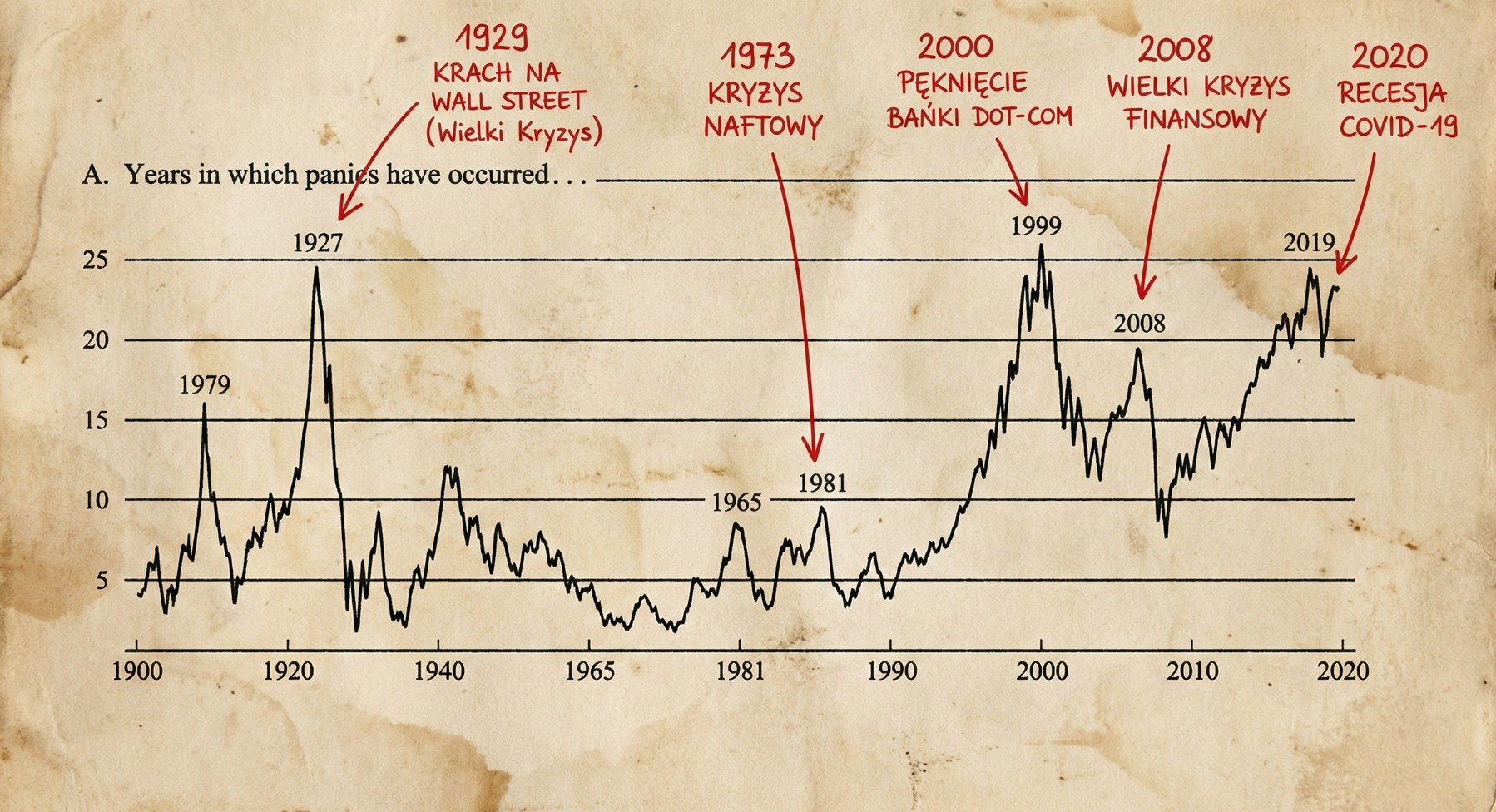

Comparison of historical crashes with long-term cycles. Source: Own elaboration based on historical data.

Part 2: The Benner Chart and 2026 – A Turning Point in the Rhythm of History

The updated Benner Cycle chart, superimposed on contemporary timelines, leaves no doubt: we are in the final, perhaps culminating, phase of the "good time." The years 2025–2027 are, according to the model, a potential area of maximum valuations, after which – in line with the cycle – a serious, multi-year correction could arrive. The year 2026 is clearly marked as the end of the boom phase (Line B) and the beginning of a long period of decline (entering the "hard times" phase of Line C).

This means that current record highs on world stock exchanges, enthusiasm around the AI revolution, spectacular gains in selected cryptocurrencies, and high real estate valuations in many regions of the world could be – in cyclical terms – the last phase of "distribution," i.e., the stage where knowledgeable investors gradually sell positions to less aware market participants before the trend reverses. After 2026, the cycle predicts even 5-6 years of a bear market, lasting until around 2032, which would correspond to the length of a typical medium-term economic depression.

Economic forecast 2026-2032 with the Benner Cycle, real estate cycle, and technological indicators overlaid. Source: Macro analysis.

Macro Context: The Convergence of Three Powerful Cycles – An Unprecedented Situation

The Benner forecast gains additional, enormous weight when viewed through the prism of other long-term rhythms identified by economists and market historians. Around 2026, for the first time in a hundred years, three powerful cyclical waves are potentially converging:

- The 90-year Gann Cycle (or "generational" cycle): It predicts major structural crises approximately every generation (roughly every 90 years). Key dates are 1837 (panic), 1929 (Great Depression), and then... around 2019+ (the COVID-19 pandemic as a potential trigger, with consequences possibly spanning the entire decade). The year 2026 falls within the peak or early declining phase of this long cycle.

- The Benner Cycle: As described, indicates a peak and phase change in 2026.

- The 18-year Real Estate Market Cycle: Derived from the work of economist Fred E. Foldvary and confirmed by analysts like Harry S. Dent, it points to regular, 18-year cycles in the real estate market, with peaks around 1973, 1990, 2006/2007. The next theoretical peak falls around 2025/2026.

Such synchronous alignment of three independent, long cycles is an unprecedented phenomenon and strongly suggests that the period 2026-2030 may be a true turning point not for a single sector, but for the global economy as a whole. This does not automatically mean disaster, but indicates a high probability of a fundamental trend change from long-term growth to long-term consolidation or decline.

Chart of major stock market crashes of the 20th and 21st centuries. Note the repetition in specific time intervals.

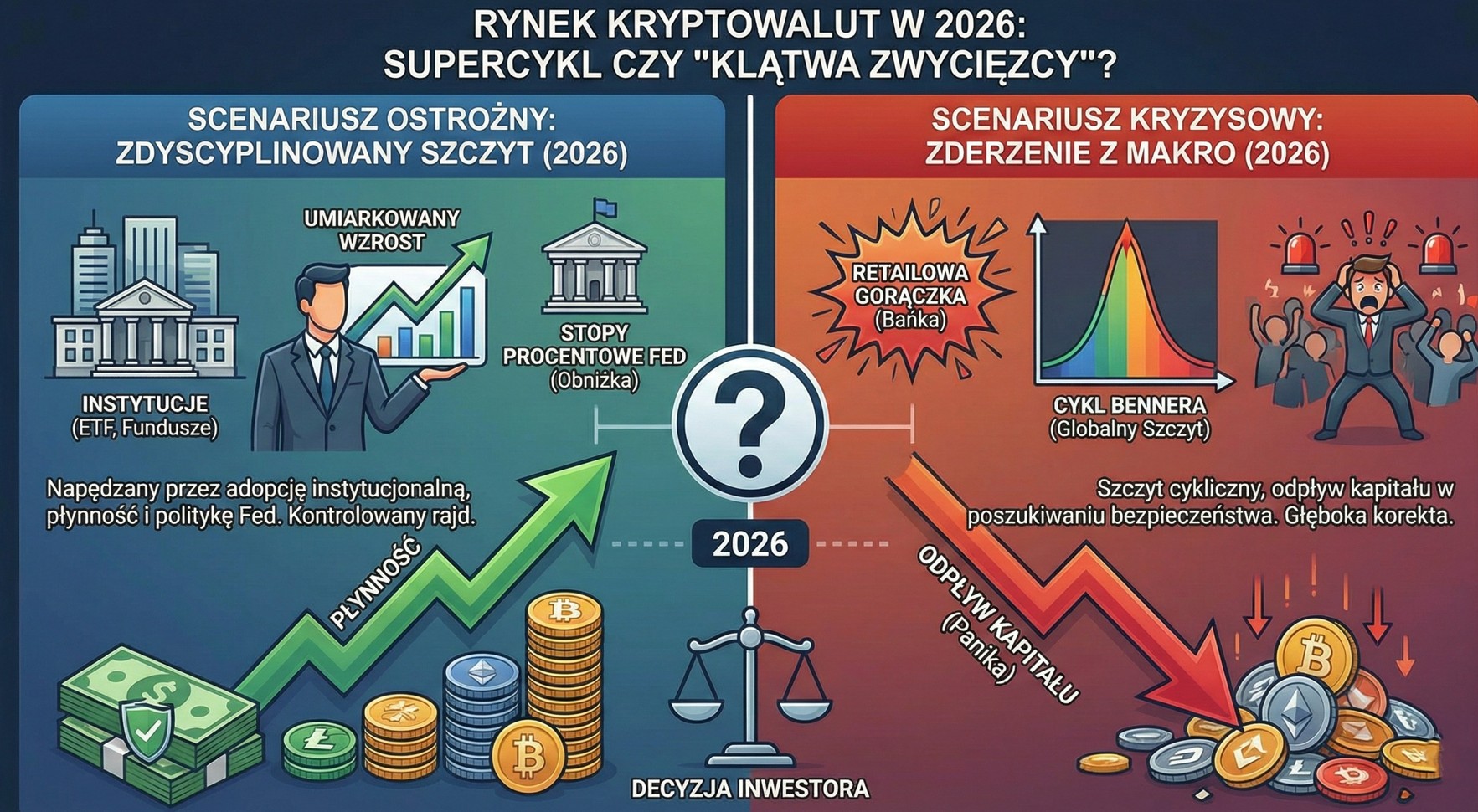

Part 3: The Cryptocurrency Market in 2026 – Supercycle, or "Winner's Curse"?

For cryptocurrency investors, the Benner Cycle has recently become the subject of intense, often emotional discussion. On one hand, the crypto community believes in breaking old paradigms, on the other – it recognizes the power of historical patterns. The Benner chart suggests that 2026 will be the "best time to sell" in the context of the broader cycle. How does this relate to current sentiments and Bitcoin's internal, 4-year cycles (related to halving)?

Cautious Scenario: A Disciplined, Institutional Peak

Many analysts combine Benner's predictions with the internal crypto cycle. The next Bitcoin halving occurred in 2024, and historically the market peak followed 12-18 months later, which would point to late 2025 / early 2026. In this scenario, rallies in 2025/26 are the final phase of a bull run fueled by a combination of factors: the last wave of retail optimism, full institutional adoption (ETFs, regulations), and liquidity from potential interest rate cuts. However, this peak may be more "stable" and less speculative than in 2021, dominated by larger players, which could mean a slower but more stable subsequent decline, rather than a catastrophic crash.

Crisis Scenario: Clash with Macro and Flight to Safety

This is where the main warning from the Benner Cycle comes in. If 2026 turns out to be a global, macroeconomic cyclical peak, then any liquidity "steroids" for the crypto market (rate cuts) could coincide with the beginning of a broader bear market in stocks and commodities. In such a scenario, cryptocurrencies, as assets at the very "end of the risk curve" (most volatile and speculative), would experience sharp, massive capital outflows in search of safety (fly-to-quality) to the dollar, treasury bonds, or gold. The peak in 2026 could therefore be a sharp, narrow top, followed by a deep and long "crypto winter," perhaps the deepest in history, perfectly fitting into the 5-6 year declining phase of the Benner Cycle until 2032.

A key indicator to watch will be the behavior of traditional markets (S&P500, VIX) and Fed policy. Potential rate cuts in 2026, instead of fueling another wave of bullishness, could turn out to be "sell-the-news" and signal that the cycle is reversing.

Part 4: The Real Estate Market – The 18-Year Rhythm and "Winner's Curse"

The real estate market has its own well-documented 18-year cycle, which correlates almost perfectly with Benner's predictions for 2026. This cycle consists of phases: recovery, expansion, over-supply, and recession. The mechanism is well-known: a long period of low interest rates (like after 2008 and in 2020-2022) fuels cheap credit, driving up prices and encouraging development investments. The last 3-4 years of the cycle are the phase of the so-called "Winner's Curse," where the belief that "property prices always rise" becomes widespread, developers start a record number of new projects, and banks grant loans under maximum, often tight conditions.

Schematic representation of the key phases of the Benner Cycle with a forecast for 2024-2027.

The convergence of the 18-year real estate cycle and the Benner Cycle indicates that the peak in the housing market in many developed economies (USA, Canada, parts of Europe, Australia) may indeed occur around 2025-2026. However, the current context is exceptionally dangerous. High interest rates introduced in 2022-2024 have already significantly cooled credit demand and increased the cost of servicing existing variable-rate loans. At the same time, a huge pool of commercial real estate (CRE) loans has refinancing deadlines concentrated precisely around 2025-2027. If rates remain relatively high during this time, and the value of collateral (office buildings, shopping centers) declines, this could trigger a liquidity crisis in the banking sector.

In Poland and Central and Eastern Europe, the situation is somewhat different due to strong structural demand and EU funds, but the global trend and high cost of capital could exert pressure. A recession in the real estate sector has a powerful multiplier effect – it hits construction, finishing industries, appliance sales, and, through the wealth effect (less wealthy consumers) – overall consumption. This directly impacts GDP and corporate profits, potentially amplifying a bear market in capital markets.

Schematic action plan for an investor during the peak of the cycle (2025-2026) and after its potential passing.

SEO Summary for www.payal.pl

Page Title: Payal.pl – Independent market analysis, investment strategies, and capital management

Meta Description: Payal.pl is a portal for conscious investors. We offer in-depth market analysis (including the Benner Cycle 2026), financial planning tools, and education. Build the resilience of your portfolio for the upcoming changes.

Keywords: market analysis, Benner Cycle, 2026 investments, portfolio management, personal finance, cryptocurrencies, real estate, capital market, defensive strategies, investment education.

Conclusions and Strategic Action Framework for 2025-2030

The Benner Cycle is not a crystal ball or the holy grail of investing. As a historical model, it has its limitations – it does not directly account for today's complexity of derivatives, global networks of interconnections, the unprecedented role of central banks, or geopolitical shocks. Its extraordinary strength lies elsewhere: in reminding us of the immutability of crowd psychology and the existence of long, structural business cycle waves that verify all "this time is different" claims.

For the individual investor, the coming period requires not speculation, but strategic caution and preparation:

- Switching to Defensive Mode and Increasing Liquidity (2025-2026): The years immediately before the indicated turning point are a time to "play defense." This means gradually realizing profits from the most speculative positions, increasing the share of cash (or its safe equivalents) in the portfolio to 20-30%, which will provide firepower for future opportunities. The key is not to succumb to euphoric rallies based solely on momentum.

- Preparing a "Wish List" and Patient Accumulation (2026+): If the cycle holds true, the years after 2026 (the "hard times" phase) could create some of the best opportunities for accumulating high-quality assets – both blue-chip cryptocurrencies and real estate or stocks of companies with strong fundamentals – at prices we could only dream of at the peak. Patience will be the most valuable virtue.

- Rigorous Diversification and Vigilance on Indicators: It is crucial to adhere to fundamental principles: diversification among asset classes with low correlation (cash, bonds, gold, real estate, stocks from various sectors), investing in assets with lasting utility value or income generation, and continuously monitoring macroeconomic indicators (Shiller P/E ratio, debt data, bond yields, sentiment indicators).

The year 2026 promises to be a potential major test of investment maturity. Whether we treat the Benner Cycle as a literal road map or merely as a deep metaphor for the cyclical nature of markets, its message is clear and consistent with the wisdom of the greatest investors: after a long period of bull markets and credit expansion comes a time of cleansing, consolidation, and bear market. History doesn't repeat itself exactly, but it often rhymes. The task of a wise investor is not to predict the future to the letter, but to build a portfolio and mindset resilient to its various versions. In the upcoming transitional period, this preparation and discipline may prove to be the most valuable asset.

Important Disclaimer: The above article is for informational, analytical, and educational purposes only. It does not constitute an investment recommendation, a recommendation within the meaning of the Polish Minister of Finance Regulation of October 19, 2005, or an offer to acquire or subscribe to financial instruments. All investment decisions are made at the sole responsibility and risk of the investor. The author and publisher are not liable for any decisions made based on the information contained in this material. Investing in financial markets involves the risk of capital loss. Before making any investment decision, it is recommended to consult with an independent financial advisor and conduct your own thorough analysis.